DIY HMRC Tax and NI for personal budget holders

The idea of doing payroll, paying tax and National Insurance for your carers or PA can seem daunting. It need not be and doing it yourself can be liberating and saves more money in your budget for you (rather than paying an agency). I have been doing it for ten years and once it is set up (depending on the number of people you employ), it only takes a couple of hours per month to do. Going through the below may seem a lot, but like everything in life the more you do it the easier it becomes. its not for everyone....

Firstly you need to register with HMRC (Tax Man) as an employer. This is relatively simple, it is done via the .gov website (https://www.gov.uk/register-

Once registered you will be given access codes to the online payroll system. Keep these safe. Do not share these. Next download the PAYE App. There are several that you can use for free. I use the HMRC app as it is best for me and does everything that I need. It can be downloaded here (https://www.gov.uk/guidance/

A useful link that helps with the process of doing payroll and explains the things that you need to do in more detail (https://www.gov.uk/paye-for-

Once you have downloaded and opened the app HMRC system. Put in the log in codes provided previously, there will be two. A number with a / and another longer one. Input these and your details and you are set up to go. The system is relatively self-explanatory. You firstly set your self up as an employer (using the codes previously sent).

You then need to set up each employee by their National Insurance numbers and individual details. have addresses, national insurance numbers, date of births close. Once done in the main screen you will see their names displayed on the right hand side. Click on them and you are set up to do the first payroll. Remember to set a date to do it and stick to this. It is just easier this way.

step by step guide can be found here:

https://www.gov.uk/government/collections/guidance-for-employers-on-using-basic-paye-tools-bpt

Once you input the pay monthly for your employees, the system works out and NI keep a note of these.

My team do contracted hours, which means I know how many hours they do every month. We run a WhatsApp group where cover is arranged for sickness. The team cover between themselves, with little input from myself. It also allows me or others to send training material, changes to systems etc out regularly.

These changes get inputted into my online calendar. I like Google as it gives the team access to it. So they can see what I have got planned and can dress accordingly (i.e. for meetings etc). Once a month I will go through the list and make any changes or additions to their monthly record.

The monthly record is created on a tab at the bottom of the records spreadsheet we created in the last blog (https://haloabletec.blogspot.

A different tab is opened using the tabs at the bottom for each member of staff. To record monthly pay, sickness, leave etc. These can also be calculated using this link: https://www.gov.uk/calculate-

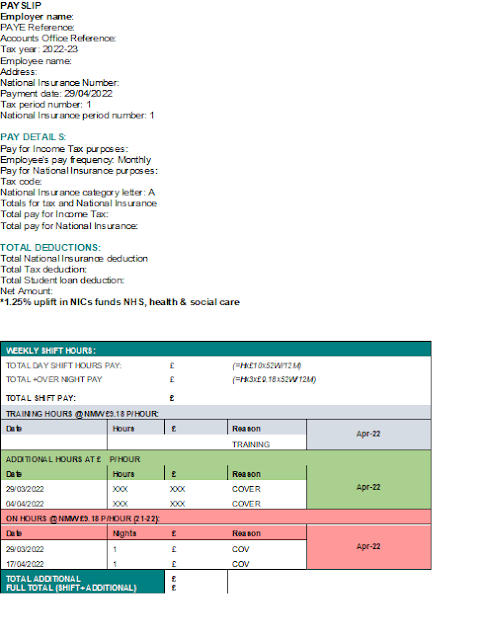

As you can see every time someone takes leave or is sick, this is recorded on their individual page. This way, I can access it from the app (see above link) from anywhere when they ask me what their leave is. I can also check there sickness etc. Once you input the hours it will calculate the tax and NI you need to pay for the staff member. Again keep a note. It will also print a record on screen. (I have used this to create a payslip by saving it in Microsoft Word and removing the info that you do not need. This is sent as a payslip to the employee via email and a copy attached to their spreadsheet tab.

you also need to send them a payslip you should have all the information to populate the details on the below

If you do not employ a system like mine but still want your staff to do pay sheets here is a calculator for you to work out there weekly hours: https://www.calculatorsoup.

You need to do this for each employee. Once done you have to send a FPS notification to the tax man, this is a monthly summary of your tax. It is important that is it done. Otherwise HMRC will not recognise that you have paid. Finally, add all of the sums on tax and NI together and pay it online here: https://www.gov.uk/pay-paye-

I do it monthly using the debit card with my personal budget bank account. One last thing is do not forget to pay the staff members what they are owed. Every year in April you have to send HMRC a final FPS that tells the tax man your sums for the year. You will be sent an email to be reminded.

It does seem a lot to take in, I started originally with only one staff member and built it up gradually. The system allows you to do up to 10 employees at once.

Comments

Post a Comment