Disability Related Expenditure - updated March 2024 v4

Disability Related Expenditure

Definition statutory guide page 1

Letter to send to Local Authorities for reassessment of DRE page 2

Letter to send to local authorities to dispute care charges page 2A

DRE List Statutory Guide page

3

DRE Advocacy List page

4

AGE UK DRE List page

7

DRE Case Law page

10

Norfolk Judicial Review easy read link ` page

13

Local Government circular link page

13

Personal Expense Allowance (care home) page

13

Minimum Income Guarantee page

13

NAFAO doc link page 15

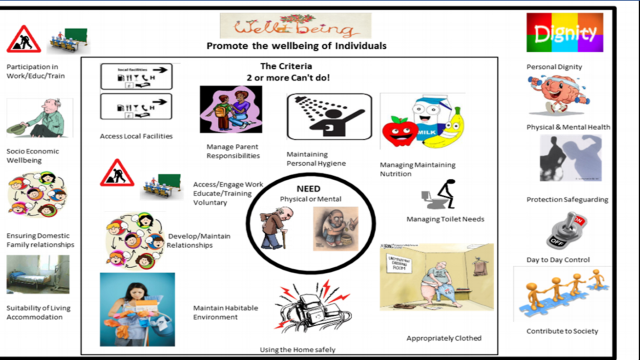

Diagram of Social Care Needs page

15

Mid Map of DRE presentation

training notes page 16

Dre pictorial guide annex c page 17/18

Definition: Disability Related Expenditure

Statutory Guidance (RV Islington)

39) Where disability-related benefits are taken into account, the local

authority should make an assessment and allow the person to keep enough

benefit to pay for necessary disability-related expenditure to meet any needs which

are not being met by the local authority.

40) In assessing disability-related expenditure, local authorities

should include the following. However, it should also be noted that this

list is not intended to be exhaustive and any reasonable additional costs

directly related to a person’s disability should be included:

Disability Related Expenditure Resource

Here’s a

letter you can use to send asking for your social care department to review

your Disability related expenditure. After which you'll find a list that you

may wish to go through and see if relevant add to the letter.

Search: Email (County or Borough name) social care in search bar.

Email address:

Date:

Dear (Local Authority) Social Care.

I am writing to enquire about having my financial assessment redone. The

reason for my request is that I have been recently informed by other people

with disabilities what their Disability Related Expenditure is. Specifically,

the items (not full list) that are included in Annexe C treatment of income of

the Statutory Guidance under the Care Act 2014. I would also like you to

consider these items that I believe fits the criteria for disability

expenditure as they relate to my needs. Some of these items may seem standard

and this may be correct for non-disabled people, however I believe that these

are very specific to me and my conditions.

List: …

Any costs that are taken off must also be backdated as I believe I was

incorrectly assessed, the authority is also responsible under the guidance on

ensuring that the advice is provided.

I look forward to receiving your response.

Regards

(Names)

(Address)

-----------------------------------------------------------------------------------------------------------------------------

ADDRESS of Authority & person’s name (from letter received)

[DATE]

[REFERNCE NUMBER]

Dear Local Authority Social Care/Finance Department – [NAME]

Dispute

of Social Care Charges Owed

I am writing to you with regard to the letter received from

you dated [ ]. The letter

is asking for a sum of [

] for charges calculated by yourselves for my Social Care Provision.

Please acknowledge that this matter is in dispute, due to

the following Disability Related Expenditures (DREs) which haven’t been deducted

from my charges since [start of assessment date].

List of DREs cost

of items x by weeks [if relevant].

Should you wish to not accept these DREs please give a

written explanation as to why not, considering the items relate to my

disabilities, as detailed in the Statutory Guidance of the Care Act Annex C. Please

also take this as a Statutory Complaint which I would like investigated, and

within the times frames and stages imposed within The Local Authority Social Services and National Health

Service Complaints (England) Regulations 2009.

Until such investigations

have occurred, I would like the matter to be on hold, any further

communications could lead to a potential incident under the harassment of debtor’s

provisions under the Administration of Justice Act section 40, as continuous

letters without going through the statutory complaints process and legal avenues will potentially

cause me distress.

After the investigation if

the authority continues to feel the money is owed, I will be happy for you to

send me an appropriate county court summons, which I will then institute the

right to dispute, via legal representation along the lines of this letter. If

successfully challenged this could lead to a claim for legal costs against the authority.

Yours sincerely [if sent to

a named person]

[Your name]

Disability

related expenditure (Not exhaustive list)

Disability Related Expenditure

(DRE)

Additional

Clothing Such as extreme wear and tear of clothing because of your impairment bedding

Such as incontinence

Additional

Footwear Such as footwear being ruined due to your impairment

Community

Alarm Such as a pendant worn around your neck to keep you safe

Gardening

Costs Such as pruning, weeding and keeping your garden tidy

Heating

Costs your heating costs are higher due to your impairment Bills from energy

provider/bank statements

Home

Shopping Delivery Supermarket delivery or paying somebody to deliver shopping

House

Maintenance DIY, repair and general maintenance of the property

Treatment

to support Well-being Such as hydrotherapy and massage session

Personal

Hygiene Incontinence pads/pants Such as incontinence pads/pants

Laundry

Costs Higher laundry costs because of your impairment medical condition Details

required about number of loads of washing each week

Privately

Purchased Care costs not met by the Council

Specific

Diet Extra food costs specific to your impairment Receipts or invoices

Short

break whilst your carer is away Such as staying in accommodation to suit your

Transport

Costs Taxis, petrol or local transport costs because of your impairment Amounts

over Disability Living Allowance/Personal Independence Payment Mobility

Purchase

& Maintenance of Equipment includes hoists, powered and turning beds,

scooter/wheelchair and stair lifts Invoices or bills from provider (excluding

any Council funding)

Wheelchair insurance

Community Alarm Electric and gas

30 % (Heating, Laundry due to arthritis/pain/health)

Electrical

Gadgets – all of which use more electricity than non-disabled people would need

to use

Recliner chair/Bed

DRE Advocacy List

Mobile – needed for safety

reasons

Computer/Broadband –

social/voluntary activities /computer equipment (mouse/dropped regularly and

needing replacement)

NHS Bed?

Stair lifts?

Door opener/Intercom/remote

control door opener & batteries

Closimat toilet uses extra

electricity and water

Wheelchair charging

Mobile phone charges

Adapted Car – uses extra diesel -

Replacement

Equipment aids Costs

Heat pads

Hot water bottles

Bedding

Cushions

Lap Trays –

activities/meals/computer

Pillows

Special mattress/ covers for

incontinence, replacement due to lifting mechanism

Charging of hoists

Clothes – underwear /jeans –

without seams for pressure sores and comfort

Shoes and socks due to swelling

and DVT

Wheel chair covers

Wheelchair bags

Portable urine bottles

Extendable Knife fork spoon

Bibs

Tens Machine – Batteries &

Pad

PA Costs

– Hand wash

– Alcohol gel

– Toilet roll

– Hot water

– Kettle

– Drinks

– Protective/medical gloves and

aprons

– Transport costs in order to

escort on public transport

– Breakages (insurance for

accident or damage)

– Holiday costs of taking PA as

well – 1 week allowed

Live

in Carer potential costs

Carpet

Electric costs

Gas costs

Laundry

Showers

Bedding

Food

Heath/Medical

Travel to

GP, Nurse and hospital appointments

Hospital– Neurology

- Blood clinic visit x

approx. 12 a year

– Eye Clinic

– Euro gynaecology

– Pain clinic

– Operations

– Chiropody

-Massage/physio

– Antiseptic Creams

Heart clinic

Breathing clinic

Eye clinic

General

Outgoings

Electric

Gas

TV costs

Shopping – internet deliveries

Food costs and dietary needs

including more frequent small meals or meals which may need to be left for

people to reheat.

Extra costs of things like

clothes and shoes – the difference between cheap ones -from-Primark and

something-which-actually-works.

Extra washing powder, more

expensive washing powders or fabric softeners.

Pet insurance if an assistance

dog

Rent above levels paid in

benefits

Mortgage payments if property is

larger than a non-disabled person would need. ie. Room needed for PA or

equipment storage

Water rates

Household insurance for

appliances relating to impairment

Servicing of any aids or

equipment

Wheelchair insurance

Gardening

Decorating

Cleaning

Having to put money aside for

future needs e.g. Repairs to equipment, deposit for Motability vehicle etc. (look

at last 2-3 years).

There is advice on the Age UK website,

of which this is an extract:

Taking disability-related

expenditure into account

If the local authority decides to

take into account your disability-related benefits, it must also take into

account your disability-related expenditure in the means test.

This is confirmed in Annex C of

the statutory guidance where it is stated that you should be allowed to

keep enough benefit to pay for necessary disability related expenditure to meet

any needs that are not being met by the local authority. A similar requirement

is made in the charging regulations.

Some local authorities

disregard set amounts to take account of disability- related expenditure

partly to avoid having to ask questions that might be considered intrusive. The

amount that is disregarded varies from authority to authority. However if you

consider your disability related costs are greater than this set amount you can

ask for a full assessment of your costs.

The statutory guidance

provides an indicative list of disability-related expenditure examples. It is

not possible for the list to be comprehensive as it will vary from person to

person. When being assessed to see how much you can pay, you should consider

everything you have to buy because of your disability. This could, for example,

include:

Extra washing, or special

washing power and conditioner for delicate skin;

Community alarms (pendant or

wrist);

special diet;

special clothing or footwear (or extra wear and tear);

Additional bedding;

Extra heating costs;

Gardening;

Household maintenance (if you

would normally have done it yourself);

Any cleaning (if not part of your

care plan);

Internet access;

Any care that social services do

not meet;

Buying and maintaining

disability-related equipment;

Factsheet 46 April 2015

paying for care and support at home

22 of 48

Any transport costs (both for

essential visits to the doctor or hospital, but also to keep up social

contacts).

It can be difficult to

prove you have extra costs if you have not actually incurred those

expenses, for example, if you have not put the heating on for fear of large

bills, or are not following a special diet because of the cost. Local

authorities should work out an amount considered to be normal expenditure on

heating, for example, for your area and type of housing to assist them in their

response to if you claim disability-related expenditure in this context, or

what you would spend if you weren’t avoiding it out of fear of high

expenditure.

There may be other

costs that should be accepted.

The courts have confirmed that

local authorities should not be inflexible but should always consider

individual circumstances. For example, an authority should not adopt a blanket

policy of refusing to acknowledge any payments made to close relatives, as

there may exceptional reasons for a particular arrangement. In one case the

local authority was criticised for not properly carrying out an assessment of

the person’s disability related expenditure by doing a home visit, and for

rejecting some items of expenditure such as swimming lessons and paying the

carer to accompany him on holiday. Such costs should be considered if they are

reasonable expenditure needed for independent living.’2

Additional suggestions

Communication aid configuration, mounting,

unmounting and charging up

Private therapies including

massage for either pain relief or anxiety

Dressings for self-injury and

extra water (OCD)

Ready meals when unable to cook

Pets – insurance and food – for

companionship and to feel safe.

CASE LAW

Local Government & Social Care Ombudsman cases

Lincolnshire County Council (21 007 887)

https://www.lgo.org.uk/decisions/adult-care-services/direct-payments

Summary: Mr B complains about the Council's decision not to allow him to use direct payments to employ his mother, who he lives with, as his personal assistant. We found fault as the Council has not properly considered whether there might be exceptional circumstances. The Council has agreed to re-consider Mr B's request and review its procedures.

London Borough of Croydon (21 001 174) – as per Norfolk Judicial Review

Council’s care charging policy is

discriminatory. She also complains the Council failed to properly consider her

disability related expenditure during a financial assessment. We find fault

with the Council for the delay in accepting her disability related expenditure.

We also find fault with the delay in the Council completing its review of its

care charging policy.

Differential impact of its charging policy on

the most severely disabled people. The council’s policy had set its Minimum

Income Guarantee (MIG) at the bare minimum.

Cambridgeshire

C Council not taking DRE in to account

PTSD, OCD –Not re assessed for

years food/caravan hobby/ DRE form difficult to understand not have relevant

info for him- so should have helped changed it. Also use light touch approach

as suggested by statutory guidance. And not do continuous yearly paperwork.

https://www.lgo.org.uk/decisions/adult-care-services/charging/18-019-337

Central

Bedfordshire Council in which a woman, who has significant disabilities, was

left without proper care and support because of a lack of proper information.

Clearer advice needed to help

service users negotiate benefits payments

It should also reconsider the

woman's disability related expenditure (DRE) and provide a clear

explanation of why it does not consider some costs arise from

her disability. The council should also pay the woman £5,000 to

acknowledge the impact on her being without adequate care and support for more

than two years and a further £2,000 to acknowledge the avoidable distress and

frustration caused.

N North Yorks County

Council has failed to carry out a financial assessment following Ombudsman investigation

htthttps://www.lgo.org.uk/information-centre/news/2020/mar/council-fails-to-carry-out-financial-assessment-following-ombudsman-investigation

The council had agreed to complete

the disability related expenditure assessment of a young woman, to

include her housing and transport costs, following her complaint to the

Ombudsman in 2018. However, despite

visiting the woman to assess her needs in July 2018, the council then failed to

share the assessment with the woman or her parents until the Ombudsman

intervened again in October 2019.

Essex County

Council to reconsider assessment of Disability Related Expenses

h https://www.lgo.org.uk/information-centre/news/2021/jun/essex-county-council-to-reconsider-assessment-of-disability-related-expenses

Essex County Council to reconsider

assessment of Disability Related Expenses the Local Government and

Social Care Ombudsman has found Essex County Council at fault in how it

considered two separate women's Disability Related Expenses (DREs).

The women both have Court Appointed Deputies to make decisions about their

financial affairs, because their disabilities mean they cannot do this for

themselves. Think of individual circumstances no good enough for council to say

we can do cheaper

Nottinghamshire man's care package reduced because of financial pressures,

Ombudsman finds

htt https://www.lgo.org.uk/information-centre/news/2020/jan/nottinghamshire-man-s-care- package-reduced-because-of-financial-pressures-ombudsman-finds

It should complete a new financial

assessment and consider all relevant Disability Related

Expenditure (DRE). It should also make a further symbolic payment of

£1,000 to the man's mother to acknowledge its failure to provide allocated

respite funds, review her carer's assessment and produce a support plan setting

out how her needs will be met. The Ombudsman has the power to make

recommendations to improve processes for the wider public.

C Cornwall Care

cost calculations criticised

htt https://www.lgo.org.uk/information-centre/news/2021/mar/cornwall-care-cost-calculations-criticised

Asking person to use personal expenditure to

a restrictive personal expenses allowance, rather than allowing him to spend

his money as he wished, within reason. Personal expenses allowances only apply

when the council itself is paying for care, not for people who fund their own

care. The Ombudsman is also reminding councils that they must disregard half of

a person's work pension when calculating how much they must contribute towards

their care,

North

Yorkshire 19 010 955

Lgo

ombudsman Feb 2020

15 month response for DRE

expenditure to long. Should consider at financial assessment stage.

Older people in

Solihull could be refunded incorrectly calculated care charges

ht https://www.lgo.org.uk/information-centre/news/2016/jun/older-people-in-solihull-could-be-refunded-incorrectly-calculated-care-charges

In this case, the LGO found Solihull Metropolitan Borough Council may have demanded charges from 63 older people in the borough after assessing their finances incorrectly. The LGO was contacted by the family of a man who had been charged the full cost of his care by Solihull Council because it had i

London Borogh of Enfield 20 Aug 24

Not giving enough support to family

London Enfield DRE 13 Feb 24

Didn't consider Dre properly or respond approaotely to care charges owed.

https://www.lgo.org.uk/Decisions/Archive?t=both&fd=2022-03-31&td=2023-03-31&c=1%2bAssessment+and+care+plan&dc=c%2Bnu%2Bu%2B&sortOrder=descending

Durham 02 jan 24

Distress caused not provided with care it assessed appropriately, failed to review and provide proper personlised budget, no choice but direct payments. Human rights not considered as part of complaints

https://www.lgo.org.uk/decisions/adult-care-services/direct-payments/23-003-726

Parliamentary and Healt ombudsman cases

Trust took too long-year to start

PHB complex learning disability child

1136

ic2 2016

Discharge from hospital of

dementia patient led to £4000 in care charges as incorrect assessment from

hospital

8

October 2019

Missed calculation of care plan

led to paying back £250,000 in care costs

Hardy

V Sandwell 2015 housing benefit case using

disability living allowance to say use that:

“In my judgment the Council’s

approach is an example of indirect or Thlimmenos discrimination because it

treats disabled applicants and their disability-related income in exactly the

same way as it treats others and their non-disability related incomes, giving

rise to unfavourable treatment to the disabled applicants. DLA(c) is not the

same as any other income, but is awarded specially to enable disabled persons

in need of personal care to cope better with their disabilities in the way they

see fit. Equally, the pattern of expenditure of a disabled person may well be

different and more difficult to predict than that of an applicant without a

disability, the needs of the disabled may not be consistent or regular and may

require considerable one-off expenditure, sometimes at short notice.

Stephenson,

R (on the application of) v Stockton On Tees Borough Council

England and Wales Court of Appeal

(Civil Division) Jul 26, 2005

Whether family payment rule should

be adhered to as a policy or rule. Policy - only must look at individual circumstances

DRE payable to daughter due to 80 mile round

trip travel and gave up part time job. Not just religious or –opens separate blog

Norfolk case - easy read https://haloabletec.blogspot.com/2020/12/lessons-from-norfolk-social-care.html

Suffolk Case: re Holiday costs for parent carer (mother) and sons pre judicial review application successful case is:

https://www.bailii.org/ew/cases/EWHC/Admin/2021/3368.html

simplified version of above

https://haloabletec.blogspot.com/2022/07/simplifid-read-of-pre-judicial-review.html

Rw v RBWM 2023 simplified read re DRE

https://haloabletec.blogspot.com/2024/03/disability-related-expenditure-case.html

Bolton DRE Case, other expenditure ie carers meals andentrance fees are DRE. Also re using pip as charges - is a choice They dont have to

https://www.bailii.org/ew/cases/EWHC/Admin/2024/699.html

Birmingham DRE - difernce in charging people who can't work- is discrimination however court decided against as Birmingham had just gone bankrupt.

https://vlex.co.uk/vid/r-w-v-birmingham-793916669

Compare above with this later article

https://amp.theguardian.com/uk-news/2024/may/01/birmingham-city-council-accused-of-making-cuts-based-on-imagined-data

Advocacy - if family member paying rent whilst living with family? If on going and can show.

NAFAO GUIDE TO

DISABILITY RELATED EXPENDITURE 2024/2025

NAFAO GUIDE TO DISABILITY RELATED EXPENDITURE 2024/25

HEATING ALLOWANCES

Annual inflationary update based on RPI Fuel index for November 2023. At this date fuel

prices had decreased by 23.1% in the last 12 months.

The figures are obtained from Consumer price inflation tables - Office for National Statistics

from the download "consumer price inflation detailed reference tables”. The figures are found

in Table 41 detailed reference tables - % change over 12 months.

Figures for 2024/2025 Standard

N East / E

Midlands

N West / W

Midlands

Single person - Flat/Terrace £2,123.77 £2,302.16 £2,571.57

Couple – Flat/Terrace £2,801.99 £3,034.24 £3,389.15

Single person – Semi

Detached £2,255.73 £2,445.22 £2,731.39

Couples – Semi Detached £2,977.92 £3,220.12 £3,597.26

Single – Detached £2,744.38 £2,972.95 £3,325.97

Couples – Detached £3,617.69 £3,919.77 £4,379.51

ALTERNATIVE HEATING ALLOWANCE

Ofgem published annual estimates of average energy usage by house size, which can then

be extrapolated to find the average energy bills by house size.

The estimate is calculated by multiplying the kWh use by the current average unit rates and

adding in the current average standing charges (correct as at)

Gas 7.51p per kWh

Gas 29.11p per day (£106.25 per annum) standing charge

Electricity 30.11p per kWh

Electricity 52.97p per day (£193.34 per annum) standing charge

Number of

Bedrooms

Gas usage

(kWh)

Electricity

usage (kWh)

Estimated

average

annual dual

fuel energy

bill

Low 1 – 2 7,500 1,800 £1311.96

Medium 3 – 4 11,500 2,700 £1833.71

High 5+ 17,000 4,100 £2595.56

INCOME / DISREGARDS

Mandatory minimum income disregards for non-residential care and support are published in

the Care and Support (Charging and Assessment of Resources) Regulations 2014, replacing

fairer charging allowances. Rates for 2024/25 can be found at

https://www.gov.uk/government/publications/social-care-charging-for-local-authorities-2024-

to-2025/social-care-charging-for-care-and-support-local-authority-circular

Disability Related Expenditure 2024/25

Residential Care

Personal Expenses Allowance £30.15

Single Adults

Allowance 18 – 24 25 – Pension

Age

Pension Age Lone Parent

Not entitled to

any premium

£87.65 £110.60 £228.70 £110.60

Entitled to CP £140.00 £162.95 £281.05 £162.95

Entitled to DP £136.45 £159.40 N/A £159.40

Entitled to DP +

CP

£188.80 £211.75 N/A £211.75

Entitled to DP +

EDP

£160.30 £183.25 N/A £183.25

Entitled to DP +

EDP + CP

£212.65 £235.60 N/A £235.60

Couples

Allowance Under Pension

Age

Pension Age*

Not entitled to

any premium

£86.85 £174.60

Entitled to CP £139.20 £226.95

Entitled to DP £121.65 N/A

Entitled to DP +

CP

£174.00 N/A

Entitled to DP +

EDP

£138.80 N/A

Entitled to DP +

EDP + CP

£191.15 N/A

** Where one partner is over state pension credit age the Pension Age MIG applies whether

the person being assessed is under or over that age.

Children

For each child the adult is responsible for that is a member of the same household an

additional allowance of £101.25

Non means tested disability benefits

Disability Related Expenditure 2024/25

Attendance Allowance - High £108.55 Lower £72.65

DLA Care - High £108.55 Middle £72.65 Lower £28.70

PiP (Daily Living Costs) - Enhanced £108.55 Standard £72.65

If local policy on DLA/AA disregard applies on higher rate DLA/AA, disregard difference

between higher and lower rate £35.90, unless in receipt of both day and night care.

DLA or PiP Mobility Components - Disregard fully

Armed forces and war pension payments to veterans

War pensions and Guaranteed Income Payments under the War Pensions and Armed Forces

Compensation schemes are disregarded in full apart from constant attendance allowance.

Armed forces and war pension payments to war widows and widowers

£10 a week disregard of War Widows and War Widowers pension, survivors Guaranteed

Income Payments from the Armed Forces Compensation Scheme, Civilian War Injury

pension, any War Disablement pension paid to non-veterans and payments to victims of

National Socialist persecution (paid under German or Austrian law)

ASSETS

Capital below £14,250 fully disregarded.

Tariff Income of: £1 per week for every £250 (or part of £250) above £14,250 and up to

£23,250 (if the upper capital limit is applied.). N.B. These are the minimum limits required by

guidance and councils can set higher.

EXPENSES

Mortgage payments/Rent - allow full amount less any means tested benefit

paid

Council Tax - allow full amount less any Local Council Tax reduction

applied

COSTS OF DISABILITY

Figures were only attached to fuel costs in the FC Guidance and the following are

recommended allowances for possible identified items and examples of reasonable evidence

requirements prepared by NAFAO. A 3.9% uplift has been applied based on the November

2023 CPI rate.

ITEM AMOUNT EVIDENCE

Community Alarm

System

Actual cost , if reasonable Bills from or payments

to provider

Privately arranged

care

Private domestic

support

Actual cost where this is not provided

as part of the care plan but the amount

is reasonable and necessary for their

care and support

Evidence of

employment

arrangement and/or

legally correct

payments to an

employee under UK

Disability Related Expenditure 2024/25

employment and tax

law. Where agency

arranged evidence of

billing and payment.

Specialist washing

powder or laundry

£4.74 per week The assessment or

care and support plan

may identify a need. If

not evidence from

other sources and

consideration of the

nature and impact of

any health problem or

disability may provide

a guide.

Identify more than 4

loads per week

Special clothing or

footwear/additiona

l wear and tear to

clothing and

footwear.

Additional cost for

bedding

Reasonable amount for extra cost

caused by disability

The assessment or

care and support plan

may identify a need. If

not evidence from

other sources, which

may include medical

evidence, and

consideration of the

nature and the impact

of any health problem

or disability may

provide a guide.

Evidence of purchase

and payment.

Internet access Reasonable amount for additional cost

due to disability

Evidence that costs

are higher due to

disability.

Evidence of purchase

and payment.

Transport costs

necessitated by

illness or disability

Reasonable amounts over and above

the mobility component of PiP or DLA.

Where support with costs are available

from other sources but have not been

used this can be taken into account in

considering reasonableness. For

example transport to hospital

appointments or council provided

transport to a day centre.

Evidence of payment

and purchase

Special dietary

needs

Reasonable amount where

demonstrated above average dietary

costs

The assessment or

care and support plan

may identify a need. If

not evidence from

other sources, which

may include medical

evidence, and

Disability Related Expenditure 2024/25

OFFICERS GOOD PRACTICE, TRAININGAND INDUCTION GUIDE VOLUME 5 ASSESSING THE COSTS OF DISABILITY

INDEX

VOLUME 1 Introduction, Legislation and General Guidance

VOLUME 2 Glossary of Terms

VOLUME 3 Charging Policies

VOLUME 4 The Financial Assessment Process

VOLUME 5 Assessing the Costs of Disability

VOLUME 6 Charging for Non Residential Care

VOLUME 7 Charging for Residential Care (excluding Property)

VOLUME 8 Charging for Residential Care – Property Issues

VOLUME 9 Financial Protection of Service Users

VOLUME 10 Information for Service Users and Consultation

VOLUME 11 Performance Management and Benchmarking

VOLUME 12 Fast Track Review and Complaints

VOLUME 13 An Introduction to State Benefits

VOLUME 14 Case Law

VOLUME 15 Counsels Opinion

VOLUME 16 Commissioners Decisions

VOLUME 17 Useful Documents, Sample information Leaflets and

Standard Letters

Contents

1. Introduction and Interpretation

2. The Fairer Charging Guidance

3. Identifying Costs of Disability

4. Dietary Costs

5. Continence Aids

1. Introduction and Interpretation

1.1 A simple interpretation of Costs of Disability would be expenditure that is incurred by a recipient of social care services that would not be incurred by someone who does not require social care services.

1.2 An example of this would be laundry, which is an everyday expense for us all, but if it was necessary to wash more frequently because on a continence problem or to use a commercial laundry then the additional costs incurred “above the norm” could be treated as a DRE.

1.3 That principle should be applied to any consideration for a DRE allowance.

2. The Fairer Charging Guidance

2.1 The Practice Guidance issued for consultation by the Department of Health, together with work commissioned by the Disablement Income Group “Disability-Related Costs and Charges for Community Care” was considered by a group of Local Authorities representing the Association . The intention was to provide a working tool that can be used to assist in calculating disability related expenditure.

2.2 This meets the advice contained within the Practice Guidance which

states:-

“The purpose of this practice guidance is to introduce some ground rules which Local Councils can follow to establish a much greater degree of consistency, quality and equity, than has hitherto been the case”.

2.3 The Practice Guidance tends to suggest a range of items which could be allowed as disability related expenditure but provides little help in the level of allowance that should be made. This will give an immediate risk of significant inconsistency between Local Authorities and the work of NAFAO has been to produce sums that could be allowed in given circumstances. This will be of considerable assistance in providing additional consistency though there will inevitability be a need for discretion to reflect any individuals’ exceptional circumstances. This is emphasised in the Practice

Guidance which states:-

“It is true that no assessment of an individual’s disability related expenditure, which is tailored to the individual’s circumstances, is quite the same as any other assessment because peoples needs vary”. highlight by @haloabletec

2.4 Taking into account the guide should be seen as just that but it does attempt to build on the Practice Guidance setting ‘ground rules’. The use of the work produced by the Disablement Income Group gives added credibility to the working tool as it is based on empirical evidence.

2.5 The statutory guidance states that:-

“Evidence of actual expenditure may be requested at the Council’s discretion. Where receipts have not been kept, a council may request that this be done for future expenditure. It is legitimate for Councils to verify that items claimed for have actually been purchased, particularly for unusual items or heavy expenditure”.

2.6 The Practice Guidance continues by stating:-“Generally the items allowed for should be based on actual past expenditure, though in some cases estimates of annual spending based on available evidence will need to be made. Spending not incurred, as in unmet need, should not be allowed. It is not practicable for charge assessments to take account of expenditure users would incur, if they had more income”.

2.7 The Practice Guidance further suggests that allowances for the cost of disability can be for a fixed period ahead, e.g., for one year, with no retrospective adjustment if circumstances change. Service Users must however, be clearly informed that they may seek a review at any time, if their disability-related expenditure changes. This will of course require supplementary evidence of the change of circumstances.

2.8 It is accepted that reasonable evidence should be produced and Service Users exercise responsibilities, i.e.:-“If despite a request to keep future receipts, users fail to do so, it

may be reasonable, where there is doubt as to whether the expenditure is actually incurred, for Councils not to include this in the assessment. In some cases, where bills cannot be produced, e.g., for heating, it may not be practicable to make an estimate”.

2.9 The statutory guidance states that some Councils may choose to disregard a standard element of disability benefits for all users receiving them. In such cases Councils might be tempted to do this and leave the onus on the Service User to request an assessment if they feel that their individual disability-related expenditure exceeds the standard disregard. The statutory guidance therefore further requires that if this option is chosen an assessment must be carried out to identify whether the individual user’s disability-related expenditure exceeds the level of the disregard.

2.10 Such a system would still incur the administrative costs of assessment but may give a standard disregard that is not necessary at that the level.

2.11 The statutory guidance requires that the process should not be too complex, should not be primarily paper based, and should not be carried out by post. The recommended method is by a personal interview in the Service User’s own home and carried out by staff trained to guide individuals through the process.

2.12 It would be good practice to offer the Service User the opportunity to be supported by a member of the family or a friend.

2.13 The Practice Guidance highlights a range of potential expenditure that should be allowed but only in the case of fuel costs were any figures attached to them. The association has updated these figures annually using the governments ‘’All Fuel Index’’ and using a November price base. (see above)

3. Identifying Costs of Disability

3.1 The work carried out by a group of members in 2003 is circulated in January/February each year with costs updated using RPI and at the November price base. The schedule will be included on the NAFAO Website (not accessible to the public added by @haloabletec) as soon as possible.

3.2 The following were identified as potential costs of disability.

Item Amount Evidence

Community Alarm System.

Actual cost unless included in Housing Benefit or Supporting People Grant.

Bills from Provider.

Privately arranged care.

Actual cost if Social Worker confirms requirement as part of the Care Plan and Council supported care is reduced accordingly. Signed receipts for at least 4 weeks using a proper Receipt Book.

Private Domestic Help.

Actual cost if Social Worker confirms requirement as part of the Care Plan and Council supported care is reduced accordingly. Signed receipts for at least 4 weeks using a proper Receipt Book.

Laundry/Washing Powder.

£2.55 per week. The Care Plan will have identified an incontinence problem. Identify more than 4 loads per week.

Bedding. Covered by NHS Incontinence

Service/Special Sheets. See also Section 3.7

Dietary. Discretionary as special dietary needs may not be more expensive than normal. See also Section 3.6, May seek permission to approach GP.

Details of special purchases.

Clothing. Discretionary depending on an individuals circumstances. Reference within the Care Plan to abnormal wear and tear of clothing.

Water. Excess Costs, where metered supplies, over normal consumption. Research on costs of similar properties.

Gardening. Discretionary based on individual costs on garden maintenance.

As for Private Care Home.

Item Amount Evidence

Powered bed. Actual cost divided by 500 (10 year life) up to a maximum of £2.95 per week. Evidence of purchase if available.

Turning Bed. Actual cost divided by 500 up to a maximum of £5.15 per week.Evidence of purchase if available.

Powered reclining chair. Actual cost divided by 500 up to a maximum of £2.35 per week. Evidence of purchase if available.

Stair-lift. Actual cost divided by 500 up to a maximum of £4.15 per week. Evidence of purchase without DFG input.

Hoist. Actual cost divided by 500 up to a maximum of £2.05 per week. Evidence of purchase without DFG input.

Holidays. Actual additional cost in excess of normal costs for a similar holiday divided by 52.Evidence of actual cost for comparison purposes.

Prescription Charges. Cost of an annual season ticket divided by 52 or actual cost of prescriptions, whichever is less.for those not eligible for free prescriptions.

Transport. Discretionary based on costs that are greater than those incurred by an able bodied person.Note: - Mobility Allowance cannot be included in the normal financial assessment as an income but the statutory guidance states that transport costs should be allowed necessitated by illness or disability, including costs of transport to Day Centres, over and above the mobility component of DLA if in payment and available for these costs. This implies that transport costs do not need to be allowed if Mobility Allowance is considered sufficient to meet such costs. Evidence in the Care Plan for the need for specialist transport.

Communications. Discretionary based on costs that would not usually be incurred Note: - Communication, e.g. telephone or internet access is often a normal part of everyday living and therefore evidence will be necessary to confirm that the cost is disability related. Evidence of exceptional expenditure.

3.3 The above could not possibly be an exhaustive list of disability-related costs and it is also reasonable to expect that relatively few Service Users would qualify for the full range of allowance. The following were identified for possible inclusion at the Conference in October 2008 and

will be added if appropriate.

Chiropody

Clothing

Window Cleaning

Insurance/Maintenance for Disability Equipment

Physiotherapy

Acupuncture

Aromatherapy

Transport

Mobile Hairdressing

Exceptional Holiday Costs

Ironing

Adaptation Costs for Vehicles

IT Costs/Satellite TV/Socialisation

Mobile Telephones

3.4 As stated earlier the assessment of disability-related costs should not involve the Service User simply completing a claim form. The allowances detailed above should therefore be use in conjunction with a tool that will draw on information gathered during the care assessment and identified in the Care Plan and supplemented by a series of questions that will enable the Service User to be directly involved in the process.

3.5 The following questions could be asked during the financial assessment but would also use information gathered from the care assessment, to prevent unnecessary intrusion for the Service User.

Questions To Be Asked To Assess The Costs Of Disability

Evidence from the Care Plan/Care Assessment

(i) Is the Service User incontinent? YES/NO

(ii) Has privately arranged care been identified? YES/NO

If yes at what weekly level?...................................................

(iii) Has privately arranged domestic help been identified? YES/NO

If yes at what weekly level?...................................................

(vi) Has exceptional wear on clothing been identified? YES/NO

If yes at what level?……………………………………………..

(v) Has exceptional mobility needs been identified? YES/NO

If yes at what level?……………………………………………..

(vi) Does the Service User require a wheelchair? YES/NO

If yes is it manual/powered (delete as necessary) YES/NO

Questions to be asked during the assessment visit.

(vii) Do you feel that your fuel bills are excessively high? YES/NO

NB: still sight of the last 4 bills irrespective of the answer.

(viii) Do you have a Community Alarm System? YES/NO

If yes is the cost covered by Housing Benefit or

Supporting People Payment?……………………………………………….

If no what is the weekly cost…………………………………...

(ix) Do you have any medical problems that require special diet? YES/NO If yes please give details....................................................…

.......................................................................................................………...................................

...............………………………………

(x) Do you have a metered water supply? (explain) YES/NO If yes what are the last year’s costs?...................................

(xi) Do you pay anyone to maintain your garden (if there is a garden)? YES/NO

If yes at what cost...............................………………………..

(xii) Do you have a powered bed? YES/NO

If yes what was the purchase price.......................................

(xiii) Do you have a turning bed? YES/NO

If yes what was the purchase price.......................................

(xiv) Do you have a powered reclining chair? YES/NO

If yes what was the purchase price.......................................

(xv) Do you have a stair-lift? YES/NO

If yes was it privately purchased.......................................….

If yes what was the purchase price.................................…...

(xvi) Do you have a hoist? YES/NO

If yes what was the purchase price.......................................

(xvii) Do you have specialist holidays due to illness/disability? YES/NO

If yes, seek details and costs.................................................

...............................................................................................................................………………

……………………………………………

(xviii) Do you pay for your prescriptions? YES/NO

If yes, how much.................. and how frequently..................

(xix) Do you feel that you have any other costs in your daily living that are caused by

your illness or disability or that help you to live

independently..............................................................……………..

.....................................................................................................................................................

..............................................................................................................................

........................................

4. Dietary Costs

4.1 Advise from Health Authority dieticians suggest that most medical conditions can be dealt with through a healthy diet which does not necessarily involve additional or exceptional costs. These include diabetes, weight reduction or low fat diets.

4.2 Others e.g. Celiac Disease which includes Crohns is managed through special products which are available on prescription through a GP.

4.3 Some e.g. Cystic Fibrosis and certain food intolerance conditions can result additional costs but these are quite easily confirmed through a GP opinion.

4.4 Certain other medical conditions may tend to involve special dietary needs but again not always and will not always be more expensive.This could include:

– people with a heart condition.

– people recovering from strokes.

– people with a physical disability or swallowing difficulties that requires food to be blendered or chopped to enable them to feed themselves.

– people with a food allergy or intolerance to certain foods.

– people with anaemia who might need to increase the amount of red meat into their diet.

– Pregnant women, especially those who are lactating

4.5 Other issues that could be relevant include:

– high protein.

– low fat.

– low cholesterol.

– weight reducing.

– physical ability to visit shops.

– local shops versus supermarkets.

– use of a third party to shop.

– delivery charges.

– availability and cost of special foods.

– ability to prepare and cook meals.

– use of ready meals.

– need to be fed by someone else.

4.6 It may be advisable to get a GP opinion who can refer on to the Dietary Service.

4.7 Annex 2 of the Fairer Charging Practice Guidance suggests using the Family Expenditure on food and non alcoholic drinks, which could be used as a threshold above which excess expenditure due to disability should be allowed.

4.8 Councils may feel that this is too uncertain and will be confused by simple choice of Service Users on what they purchase rather than specifically related to the Costs of Disability.

5. Continence Aids

5.1 There should be a Continence Advisor in each Health Authority, Local Authorities should make contact to determine what is provided in their area.

5.2 Continence Pads are provided free of charge – though the numbers available to individual patients may vary across the country.

5.3 Service Users may choose re-usable products which would require washing,usually for light sufferers and again practise may vary.

5.4 Service Users can have special sheets which are very absorbent but these require washing daily.

5.5 Main problem area is adult Learning Disabilities who may have problems in managing the pads especially overnight.

5.6 The same issues apply to clothing i.e. problem is manageable but may be costs if not managed well – particularly in adult learning disabilities.

5.7 Some people may choose to pay for products e.g. stigma associated with asking for free products. It will require a delicate decision on whether a council is prepared to make a DRE allowance if this is the case.

Mind Map of Training

This is A great testimony on how I won my court case with the help of Priest Odaro.my own LAWER wanted to give up on the case but Priest Odaro Did a spell that makes me to win the case I was so very Happy and thank Him for the spell he did If you are facing any problem About court case I Assured you That Priest Odaro will help you And you will win the case.

ReplyDeleteVIA/Email:priestodaro@gmail.com

WHATSAPP:+2347071495718