Maximising your Personal Budget

Over the last few months I

have been contacted by a number of people, who have had reassessments of their

care and personal budgets. Though they have had an increase in their budgets. They

have been left perturbed that in the end they have been left with less money.

In this blog I hope to show those who use such services how to ensure they can

maximise their budgets to ensure they have enough to meet their needs.

This obviously doesn’t mean that you are entitled to everything that you want but your needs in essence must be met.

This obviously doesn’t mean that you are entitled to everything that you want but your needs in essence must be met.

Do you know that the Care

Act allows for you to do your own assessment with the authority basically

standing by to assist if needed (Assisted Assessments)? If you feel up to it,

why not give it a go, who knows more about your needs than you.

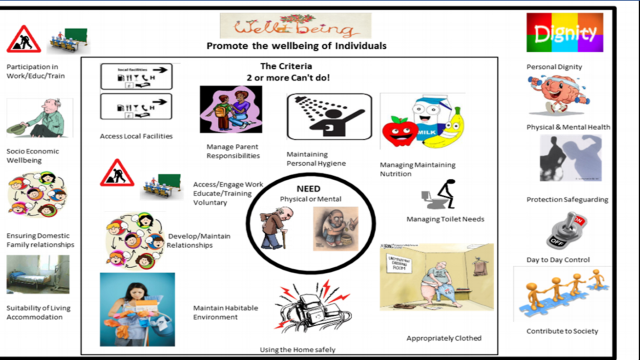

So what needs do the authorities have to meet. There is a whole list but generally they are as per the diagram at the link below.

So what needs do the authorities have to meet. There is a whole list but generally they are as per the diagram at the link below.

In order to help with this ensure you have a full detailed thorough personal plan. This is your opportunity to say what you need. In essence if it’s connected or helps with meeting the needs identified above then the authority should meet these. However they can suggest cheaper alternatives, so make sure you can justify and reason it. If you can get a doctor or specialist to back this up the better. If it’s not in the plan it will be difficult later to argue why you want that particular thing as a need though plans can be changed and do change. If things are done properly then it does make your life easier. A good way to do this is keep a week’s diary and every time you need help or think of something that you need write it down. This can be summarised later as part of the plan and can be given to carers as a basis of a care plan.

When looking at your financial assessment remember also that the authority must offer to look and advise you to ensure you are receiving maximum benefits entitlement. So make sure they’ve checked or put you in touch with someone who can. Don’t just say yes I’m on benefits ask them to check or actually put you in touch with someone who can. You will be surprised.

There are also various discounts you may get, from companies and organsiations including reduced train journeys, cinema tickets for carers, help with heating and water costs all you need to do is ask. You have nothing to loose. You may have to pay a small up front fee lile for a rail card, or cinema but if you use these services a lot, you can save yourself a lot of money.

There are some things like DLA transport allowance they will discount. However if you feel that your transport needs aren’t being met then some of this can be claimed back to. In my case my total amount of transport allowance is used in supplying me with a vehicle. It’s a large van, automatic. A person without disabilities would probably have a smaller vehicle which would be more economical. However as I’m having to use this vehicle and it’s a thirsty van. Only doing about 30 miles to a gallon, I’ve asked them to top up my allowance so that I can maintain my independence and do voluntary work.

When you receive your final personal budget make sure you check against your plan to make sure everything is costed and included. If not ask for it to be. Often this is the point most budgets in my opinion get reduced. Too often authorities cost the hourly rate of care but do not include other needs that you may have. So ensure it is checked off and a clear indication is given as to how much your budget is and what it can be spent on. Ask for a breakdown. This can save you a lot of time at annual reviews arguing with auditors, who basically go by what they’re told and aren’t aware of your needs. If you haven’t asked for it is often difficult to subsequently get it agreed in hindsight. It can be done but it will take longer and cause unnecessary work for all parties.

One of the issues people often complain to me about is how much authorites will pay. Ie the hourly rate, and being able to afford to get proper trained staff for this ammount. Firstly the Care Act doesn't mention hourly rates, it talks about your needs being met. Any payments must be appropriate to meet your needs and according to statutory guidance meet market rates. In order to check this ask your authority via a Freedom of Information Act, request ( your authority should have an oine email address) there average rates for paying care providers and persohal budget holders. If your sum is a lot lower ask for more. One of the arguments you will face is that Care companies have more on costs. To this you can advise that you as an employer must follow the same law and to get equivlant staff the pay must be at a decent (average level). Ie must be market rates. Often care companies get paid a lot more than indivduals on personal budgets, a lot of this money goes on profits for the companies. It is cheaper to offer personal budgets.

Once you have a final figure if you are still left with a large amount to pay. This may be down to savings and investments. Firstly ensure this isn’t more than the current rate. You should regardless of how much money you have be left with an amount which is the minimum income guarantee level + % whatever the cost you must be left with this amount spare. So make sure you ask what the current figure is and use this as a base line.

The next step and this is where a lot of people miss out. You must set against the payment you have to make if not already done in your assessment any disability related expenditure. Unfortunately there is not an exhaustive list. But you will find one. Contact me if you want one.

If you manage your own personal budget, there are additional expense you need to think about. If you have live in carers remember they are an expense to. Don’t forget other things including heating and use of water. Yes the government have financial guides, but these may be based on different circumstances to yours. I.e. gas/electric and water rates are based on averages of a 3 bedroom house, however if your living in a one or two bed bungalow and have the heating on as suggested by the NHS on at least at 18 degrees because you’re not ambulant and get cold. You may find as I did that this doubled your bills. I asked my non-disabled neighbours who live in similar properties and the electricity firm for a more specific average and got figures which were higher than those used by the local authority. I therefore argued the difference as it was an additional cost.

I know some authorities have brought in banding for disability related expenditure. But if your costs are higher than your banded rate, then ask for a full review and your full entitlement, cost it, ask for it, it is your right.

Most of the general public don’t realise how expensive it is to be disabled. Current statistics show that you will spend an additional £600 a month on disability related expenditure. It is therefore essential that you claim what you are entitled.

Other things you may also want to look at is checking with your energy company if they do any discounts. The top 6 suppliers in the country are part of warm home scheme. Which regardless of your age if you need additional heating you may be able to apply for and get a rebate of about £140. Also don’t forget if you are buying anything specific to your disability needs you may be entitled to Vat re bate so ensure you check with the supplier. All you have to do is fill in simple form and hand it to the supplier and he can deduct the vat off.

I know times are hard for everyone these days. But everything I’ve written here is what you’re entitled to and no more. The majority of this money is already budgeted for by the government and often remains unclaimed. Often people miss out due to lack of knowledge and in some cases just tiredness of having to continually fight to get their entitlement. However once you’ve done it once it does get easier.

Finally for those who think I just want to live and not have to worry about all this, remember the Care Act actually now allows for you to claim money for family members to help you manage your budget, it’s not a paid job but the administration and management can be charged for and agreed as part of your budget.

Comments

Post a Comment